Lo más reciente

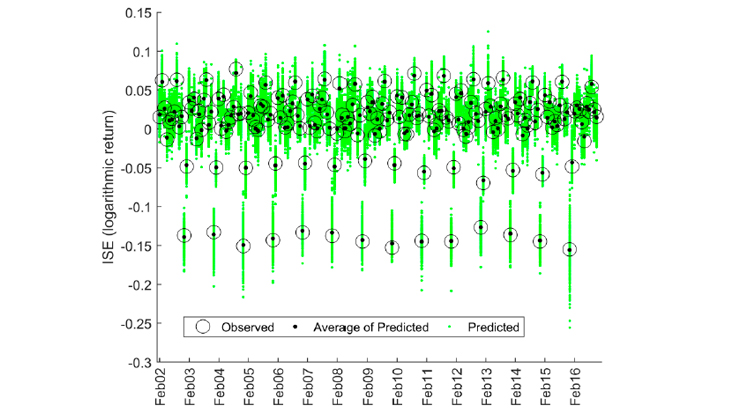

Economic activity nowcasting (i.e. making current-period estimates) is convenient because most traditional measures of economic activity come with substantial lags. We aim at nowcasting ISE, a short-term economic activity indicator in Colombia. Inputs are ISE’s lags and a dataset of payments made with electronic transfers and cheques among individuals, firms, and the central government. Under a predictive modeling approach, we employ a nonlinear autoregressive exogenous neural network model. Results suggest that our choice of inputs and predictive method enable us to nowcast economic activity with fair accuracy.

Also, we validate that electronic payments data significantly reduces the nowcast error of a benchmark non-linear autoregressive neural network model.

Nowcasting economic activity from electronic payment instruments data not only contributes to agents’ decision making and economic modeling, but also supports new research paths on how to use retail payments data for appending current models.