The most recent

Abstract

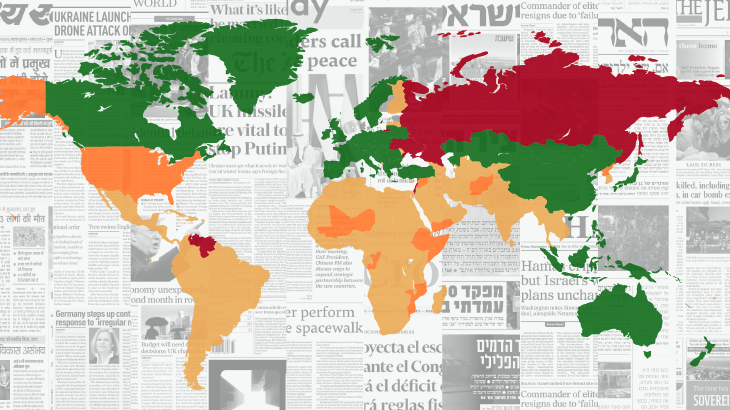

This study examines the determinants of sovereign risk, focusing on the impact of geopolitical risk in emerging market economies (EMEs) sovereign risk metrics. Using local projection techniques, we evaluate the effects of geopolitical risk on credit default swaps (CDS) and EMBI indices in EMEs, including the recent war between Ukraine and Russia. Our findings highlight the significance of considering geopolitical risk when analyzing risk premiums for emerging markets. Notably, we find that the impact of geopolitical risk shocks on CDS is higher than the effect on EMBI spread dynamics. Furthermore, using recursive estimations, we show that the effect of geopolitical risk on sovereign CDS and EMBI spreads has been relatively stable. On the other hand, we find an important degree of heterogeneity across countries by analyzing evidence from individual countries. Some countries in our sample seem statistically unaffected by geopolitical risk, particularly when examining EMBI dynamics.